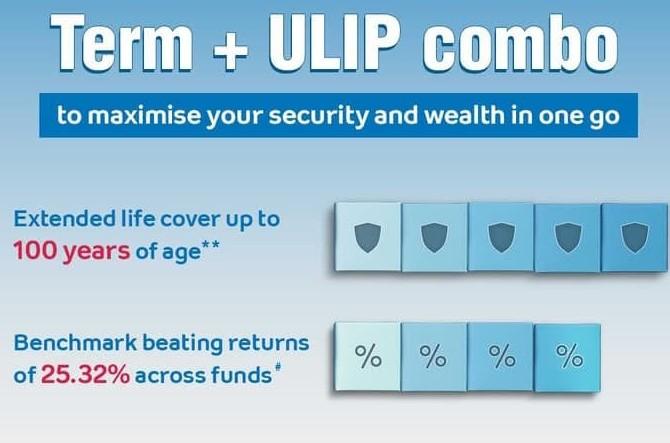

Tata AIA Param Raksha - Term Insurance with ULIP

Tata AIA Param Raksha Life Pro offers comprehensive life insurance coverage combined with marker linked returns4 for wealth creation, ensuring your family's financial security and long-term growth. With flexible premium payment options this plan provides peace of mind for life's uncertainties.

for more Details plz click below:

Benefits of Tata AIA Life Insurance Param Raksha-Term Insurance Plan

Life Insurance Coverage

Get life insurance coverage for up to 100 years with this plan to protect your family for many years to come!

Tax Benefits

Get Income tax7 benefits as per applicable tax laws.

Accidental Death

Safeguard your family with additional Sum Assured in case of Accidental Death and 2X2 Additional Sum Assured in case of unfortunate accidental death in public transport or other specified circumstances.

Comprehensive coverage

The Tata AIA Life Insurance Param Raksha Life Pro offers a life cover, disability cover and savings solution so that you and your family can receive comprehensive coverage.

Choice of Funds

Choose from multiple fund options provided under the plan or opt for the Enhanced Systematic Money Allocation & Regular Transfer (Enhanced SMART) portfolio strategy.

Flexible Premium Payment

Choose between the Regular Pay or Limited Pay options to pay the premiums towards your policy, at your convenience, on an annual basis.

Return of Fund Value

Receive the fund value of your investment on the maturity of the policy to boost your savings.

Accidental Total and Permanent Disability

If you suffer a total and permanent disability due to an accident, your family will receive a lump sum amount under the Accidental Total and Permanent Disability Benefit to replace the loss of income due to your disability and 2X2 benefit in case of accident occurs in public transport or other specified circumstances.

Flexible Premiums Payments

Make easy annualized premium payments for your base policy as per your premium payment mode and term to avail life cover.

Tata AIA Vitality (Wellness Program)

A comprehensive wellness program that helps you understand and improve your health thereby offering premium discounts9 of up to 10% on Tata AIA Vitality Protect Advance premiums in the 1st year.

Check Eligibility

Boundary conditions | |||||

Min/max age at entry | 18/65 | ||||

Max. age at maturity | Life Cover: 100 years Accidental Death Benefit: 85 years Accidental Total & Permanent Disability: 85 years | ||||

Policy term | Min: 30, Max: subject to max. age at maturity | ||||

Premium payment term | 5 to up to 85 years of age for limited pay and Regular pay | ||||

Minimum Premium | SSR Supreme Premium: Limited Pay 5-6 years: ₹ 20,000 p.a. Limited Pay 7-9 years: ₹ 18,000 p.a. Other Premium Payment Terms: ₹ 15,000 p.a. | ||||

Premium Mode | Annual, Half yearly, Quarterly and Monthly | ||||

Sum Assured |

| ||||

Boundary conditions | |||||

Min/max age at entry | 18/65 | ||||

Max. age at maturity | Life Cover: 100 years Accidental Death Benefit: 85 years Accidental Total & Permanent Disability: 85 years | ||||

Policy term | Min: 30, Max: subject to max. age at maturity | ||||

Premium payment term | 5 to up to 85 years of age for limited pay and Regular pay | ||||

Minimum Premium | SSR Supreme Premium: Limited Pay 5-6 years: ₹ 20,000 p.a. Limited Pay 7-9 years: ₹ 18,000 p.a. Other Premium Payment Terms: ₹ 15,000 p.a. | ||||

Premium Mode | Annual, Half yearly, Quarterly and Monthly | ||||

Sum Assured |

| ||||

Contact us to know more on this plan/product

SubmitDetails